Canada luxury real estate market sales fall but don’t blame buyers

People are eager to buy homes, if only there were enough listings

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

Good morning,

Advertisement 2

Article content

Article content

Luxury home sales retreated across much of Canada this past winter, but a lack of buyers isn’t to blame for the pullback and the market is expected to pick up this spring, according to Sotheby’s International Realty Canada.

Sales of luxury real estate properties were slower in the first quarter of 2023 compared to the same time last year, with Toronto, Vancouver, Montreal and Calgary all registering declines, says Sotheby’s latest report on the state of high-tier housing.

Toronto and Vancouver, the most expensive housing markets in Canada, bore the brunt of the slump in sales. In Toronto, sales of luxury homes priced $4 million and higher fell 64 per cent from the first quarter of 2022. Transactions of houses above $1 million also slowed, declining 57 per cent over last year. Vancouver sales of residences over $4 million were down 53 per cent year over year, and sales of dwellings above $1 million fell by 51 per cent.

Advertisement 3

Article content

Montreal’s market also climbed down from 2022 levels, with sales of luxury properties above $1 million declining 43 per cent in the first quarter compared to last year. Residences priced at $4 million and higher experienced a slowdown in sales, too, falling 33 per cent year over year.

Meanwhile, Calgary remains a bright spot in the market amid a growing economy that’s attracting new residents from other parts of Canada. But it too experienced slower sales when compared to the same time last year. Sales of $1-million homes fell 36 per cent compared to the first quarter of 2022. However, Sotheby’s says sales are up 223 per cent compared to the same time in 2020, which shows the underlying strength of the market.

The overall drop in home sales isn’t a sign that buyers have given up on homeownership, however. Sotheby’s blames a lack of listings for the downturn in transactions, and says people are ready and eager to get back into the market to find their dream homes.

Article content

Advertisement 4

Article content

“A significant cohort of prospective homebuyers and sellers who were reluctant to make a move in 2022 … are now pre-qualified, highly motivated and anxious to find a home that meets their needs and lifestyle,” Don Kottick, chief executive of Sotheby’s International Realty Canada, says in a press release.

Investors also continue to have faith in real estate, with recent research from Sotheby’s and Mustel Group showing that 60 per cent of city-dwelling Canadians believe property will outperform or line up with their other investments over the next 10 years.

That high confidence, combined with pent-up demand, bodes well for the spring housing market, the report says, providing there is enough inventory to meet buyer intentions. Sotheby’s says many sat on the sidelines this winter, in the hope of more inventory coming online in the second quarter. But listings are expected to stay muted, which will likely constrain sales.

Advertisement 5

Article content

“The greatest challenge that (buyers and sellers) are facing is a sheer lack of housing supply across every price point and housing type,” Kottick said. “This shortage is placing a chokehold on real estate markets that would otherwise be primed for healthy activity.”

Still, don’t expect a lack of listings amid a cohort of motivated buyers to translate into big price gains this spring. Higher interest rates that have pushed up the costs of homeownership are keeping people from bidding up prices further, Sotheby’s says. Indeed, inflation data from Statistics Canada released on April 18 shows mortgage interest costs increased 26.4 per cent last month from March 2022. That should continue to keep a lid on home prices this spring, even as the market picks up.

Advertisement 6

Article content

“Properties priced appropriately for the market will see qualified interest and uptake in the coming months,” Kottick said.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

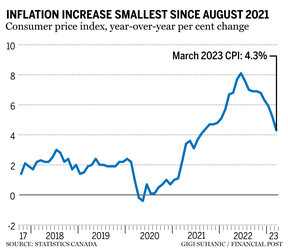

Inflation appears to finally be slowing, which means interest rate increases are likely off the table, at least for now, writes Kevin Carmichael.

The consumer price index increased 4.3 per cent from March 2022, Statistics Canada said on April 18. That was the smallest year-over-year increase since August 2021.

Excluding food and energy, the year-over-year increase was 4.5 per cent, down from 4.8 per cent in February. Excluding mortgage interest costs, the index increased 3.6 per cent, compared with 4.7 per cent the previous month.

Advertisement 7

Article content

Still, though headline inflation is lower to four per cent than its eight per cent peak, it might not feel like much a of a relief for many households. Find out more about what you need to know about the latest consumer price reading.

___________________________________________________

- 150,000 PSAC members comprised of Canada Revenue Agency and Treasury Board workers walk off the job today in what will be the largest federal public service work stoppage since 1991. Here’s what you need to know about how demands for wage increases could affect inflation

- Suzanne Clark, chief executive of the U.S. Chamber of Commerce, attends a breakfast event in Ottawa, organized by the American Chamber of Commerce in Canada in partnership with the Business Council of Canada and the Canadian Chamber of Commerce

- Canada 2020 hosts the Net-Zero Leadership Summit in Ottawa. Speakers include Environment Minister Steven Guilbeault and Northwest Territories Premier Caroline Cochrane

- Imperial Oil Ltd. holds its 2023 investor day and provides an update on its operations and business strategy

- The United States Federal Reserve Board releases the latest Beige Book report

- Today’s data: Canadian housing starts, industrial product and raw materials price indices

- Earnings: Tesla Inc., Morgan Stanley, IBM Corp., Kinder Morgan Inc., Nasdaq Inc., Equifax Inc., Metro Inc., Alcoa Corp.

Advertisement 8

Article content

___________________________________________________

_______________________________________________________

-

Inverted yield curve with a side order of (possible) recession

-

Getting inflation below 3{61deb032f2f3cf43cd91e0a97f017aab274ddbb67b74a5b085bd003b9ac3cd96} won’t be easy: Frances Donald

____________________________________________________

Rich people have problems, too, but the advice financial planner Ed Rempel provides for one couple trying to ensure a comfortable retirement applies just as much to the rest of us as it does to them. Do we have enough money to maintain our lifestyle? How can we pass some money to our kids in a sensible way? Where should I park the capital that’s currently sitting in guaranteed investment certificates? Retirement advice this way.

____________________________________________________

Today’s Posthaste was written by Victoria Wells (@vwells80), with additional reporting from Financial Post staff, The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation